Discover Affordable Mortgage Options with a Trusted Mortgage Broker San Francisco

Discover Affordable Mortgage Options with a Trusted Mortgage Broker San Francisco

Blog Article

Discovering the Services Offered by a Mortgage Broker for First-Time Purchasers

Comprehending Home Mortgage Kinds

When beginning on the trip of homeownership, comprehending the various kinds of home loans is critical for first-time customers. Home loans are economic tools that permit people to borrow funds to buy a home, and they can be found in numerous types, each with unique functions and advantages.

The most common type is the fixed-rate home loan, which offers a stable rate of interest throughout the loan term, usually ranging from 15 to 30 years. This predictability makes budgeting easier for homeowners. Conversely, adjustable-rate mortgages (ARMs) feature rising and fall rate of interest prices that can alter after an initial set period, possibly causing lower initial settlements but enhanced threat with time.

One more option is the government-backed financing, such as FHA, VA, or USDA fundings, which deal with specific customer needs and typically call for reduced deposits and credit history. For customers looking for flexibility, interest-only home loans enable lower initial repayments, though they might lead to larger payments in the future.

Recognizing these home loan types equips new purchasers to make educated decisions that align with their lasting plans and financial goals. Involving with a home mortgage broker can supply beneficial understandings customized to private conditions, better simplifying the decision-making process.

Assessing Financial Situations

Assessing monetary circumstances is a critical action for new homebuyers, as it lays the foundation for identifying affordability and suitable home mortgage options. A comprehensive evaluation entails taking a look at income, costs, credit history, and savings, which jointly shape the customer's economic account.

Credit history play a substantial function in mortgage qualification and interest prices; therefore, new customers should get and examine their credit history reports. Identifying any disparities or areas for improvement can boost their monetary standing when obtaining a loan.

In addition, assessing savings is vital, as it establishes the dimension of the deposit and can influence mortgage terms (mortgage broker san Francisco). Purchasers need to aim to have a minimum of 3% to 20% of the home rate conserved for the deposit, in addition to added funds for closing reserves and expenses. A thorough analysis of these components will equip new buyers to make educated choices in their homebuying trip

Navigating the Application Refine

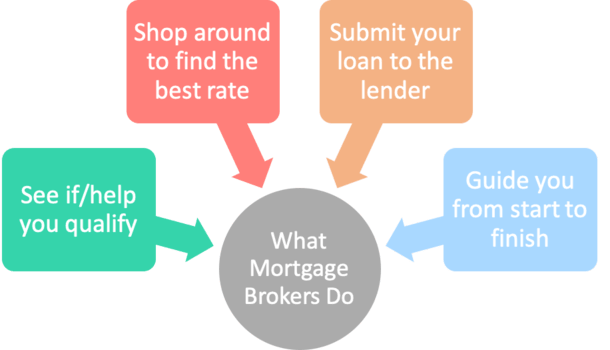

Browsing the application process can be a daunting experience for novice property buyers, as it entails a collection of crucial steps that need to be finished properly and effectively. Mortgage brokers play a pivotal function in simplifying this journey, supplying important assistance and assistance throughout.

At first, the broker will help gather necessary paperwork, consisting of income verification, employment history, and credit history records. Making certain that all documentation is arranged and exact is necessary, as any kind of disparities can bring about hold-ups or beings rejected. The broker likewise helps in completing the mortgage application itself, ensuring that all required fields are filled in appropriately.

When the application is sent, the broker serves as a liaison between the customer and the lending institution, maintaining the lines of communication open. They proactively address any inquiries or concerns raised by the lending institution, which can speed up the approval procedure. Furthermore, brokers commonly offer understandings into prospective contingencies or problems that may arise during underwriting.

Contrasting Loan Provider Options

After completing the application procedure, newbie property buyers should assess various lender options to safeguard one of the most positive mortgage terms. This vital step involves contrasting rate of interest, lending types, and settlement choices provided by various loan providers. Each loan provider might offer unique benefits, such as reduced closing expenses, flexible settlement routines, or specialized programs for novice customers.

Rates of interest play a critical duty in figuring out the overall expense of the mortgage. Debtors need to take into consideration whether a repaired or variable price is much more advantageous for their monetary situation. Dealt with prices provide security, while variable rates might provide lower first repayments yet come with prospective variations.

In addition, it is important to assess loan provider credibilities - mortgage broker san Francisco. Looking click to investigate into consumer reviews and ratings can supply understanding into their solution quality and responsiveness. Newbie buyers ought to ask regarding any kind of readily available support programs that specific loan providers could supply, which can relieve the monetary problem of purchasing a home.

Ultimately, a comprehensive contrast of loan provider choices equips new buyers to make enlightened choices, guaranteeing they choose a home mortgage that aligns with their long-term financial objectives and homeownership aspirations.

Giving Ongoing Assistance

Ensuring first-time homebuyers really feel sustained throughout their home loan trip is necessary for promoting confidence and complete satisfaction. A mortgage broker plays a pivotal role in this procedure by supplying continuous assistance that expands beyond the preliminary finance approval. From the moment customers reveal rate go right here of interest in purchasing a home, brokers are available to respond to questions, make clear terms, and address problems that might develop during the purchase.

Brokers also maintain clients informed concerning the various phases of the mortgage process, ensuring they recognize what to anticipate and when. This proactive interaction helps ease anxiousness and enables buyers to make educated choices. Furthermore, brokers can help in browsing any kind of obstacles that might emerge, such as concerns with paperwork or adjustments in financial conditions.

Post-closing assistance is just as vital. A skilled broker will follow up with clients to ensure they are pleased with their home loan terms and provide guidance on future refinancing choices or modifications necessary for financial security. By maintaining an open line of communication and offering expert recommendations, home mortgage brokers empower newbie customers, assisting them really feel safe throughout their whole homeownership journey.

Verdict

In summary, home loan brokers play an important function in promoting her response the home-buying procedure for first-time customers. Their experience in recognizing different home loan types, analyzing monetary scenarios, and navigating the application process enhances the overall experience. By comparing lender options and providing continuous assistance, brokers equip customers to make educated decisions. This extensive aid ultimately cultivates self-confidence in accomplishing homeownership, highlighting the worth of expert guidance in what can be a complicated journey.

Home loan brokers offer as necessary allies in this elaborate landscape, offering a range of solutions tailored to reduce the concerns of getting a home mortgage. mortgage broker san Francisco. A home loan broker plays a pivotal function in this procedure by offering recurring aid that prolongs past the initial loan approval. A skilled broker will adhere to up with clients to ensure they are pleased with their mortgage terms and supply guidance on future refinancing choices or changes necessary for monetary security. By maintaining an open line of interaction and offering specialist guidance, home loan brokers equip new purchasers, aiding them feel protected throughout their entire homeownership trip

In recap, home mortgage brokers play a critical role in promoting the home-buying procedure for first-time buyers.

Report this page